Photo by Geralt, via Pixabay

Attract the Right Job or Clientele:

How to Sell to the CFO to Enjoy Business Growth

Chief financial officers (CFOs) prioritize choices that improve profit and have clear timelines. Sales teams that present outcomes, timelines, and factual numbers earn attention.

Our guest blog, ‘How to sell to the CFO to enjoy business growth, offers insights on crafting a business case that demonstrates a return on investment (ROI), mitigates risk, and fosters long-term value creation—everything a CFO needs to know.

____________________________________________________________________________________________________

Sell to the CFO to Enjoy Business Growth

Image by Geralt, Pixabay

Start With the CFO’s Scoreboard

CFOs prioritize earnings before interest, taxes, depreciation, and amortization (EBITDA), free cash flow, gross margin, and risk-adjusted return on investment (ROI) or payback time. Lead with how the solution increases contribution margin, accelerates cash conversion, or reduces volatility, aligning benefits to the company’s financial plan.

Translate Benefits Into an ROI Mode

Quantify ROI and illustrate how economics move through the income statement and cash flow. Develop a straightforward model that the finance team can easily review—present base, conservative, and upside scenarios to showcase risk and sensitivity.

Include:

- A clear baseline that shows current cost, cycle time, and conversion rates

- Unit cost down, throughput up, and error rate down for each lever

- A time-to-value map that shows quick wins in the first quarter and compounding gains after

- A monthly payback calculation, plus net present value with the company’s hurdle rate

- A sensitivity table for one or two key drivers, like adoption and utilization

- A cost of delay estimate that reflects a dollar loss, the CFO can validate

Connect to What CFOs Say They Need

Policy and technology drive capital allocation. The 2025 findings reveal that 57% of CFOs are adjusting their short-term strategies due to U.S. economic policy, and 58% are investing in AI for real-time forecasting and enhanced planning.

44% of CFOs say cost discipline is “essential” to fund increased tech use over the next 12 months to reduce costs. A pitch tied to these pressures stands out because it fits the budgeting reality.

Prove Revenue Protection and Cost-Out With Specific Cases

Demonstrate value with short, verifiable applications tied to profit. For example, real-time fraud screening protects revenue, reduces chargebacks, and lowers manual review costs. Mastercard uses AI that scores transactions within milliseconds, demonstrating how advanced detection reduces loss and preserves customer approvals. Revenue integrity also controls costs by reducing false declines and supporting workload efficiency.

Treat Risk Reduction as a Measurable ROI Lever

CFOs value projects that reduce loss exposure—frame risk value by highlighting the financial impact of fraud. In 2023, consumers filed 2.6 million fraud reports with the Federal Trade Commission, and reported losses topped $10 billion. That scale demands stronger prevention and faster detection.

Mention that memory-enabled AI learns from transactions, flags unusual patterns in real time, and improves over time, helping finance teams catch fraud faster, manage risk, and protect customers and cash flow. When quantifying avoided losses, show baseline fraud rate, expected reduction, average ticket size, and approval rate increases to turn risk control into EBITDA.

Treat Churn Like a Cash Flow Problem

Customer churn changes lifetime value and cash predictability, influencing how a CFO assesses risk pricing. Differentiate between voluntary churn, when a subscriber cancels on purpose, and involuntary churn, which occurs when a payment fails or billing creates preventable friction.

Recurring billing data can mislead regarding churn. If a company loses subscribers as remaining customers upgrade their plans, it can hide a long-term, value-eroding leak. Finance wants precise instrumentation, payment retry logic, and card updater practices to prevent involuntary churn and ensure a fast payback.

Quantify Efficiency in the Language of Throughput and Capacity

AI-driven planning and forecasting enable higher-value analysis, improving pricing, inventory, and working capital decisions—outcomes that CFOs strive for.

CFOs value efficiency gains that increase output. Demonstrate that the solution eliminates manual steps, reduces cycle time, and minimizes exception handling. Tie gains to gross margin by showing less labor absorption, overtime, and rework.

Build Credibility with Measurement, Governance, and Shared Ownership

Finance leaders want clear metrics and roles. Outline data sources, controls, and how the team will measure uplift or savings in the company’s systems. Define ownership for adoption, data quality, and process change to ensure accountability. Implement quarterly checkpoints to track savings and adjust assumptions.

Remember to set expectations: CFOs value artifacts that reduce ambiguity, clarify risk, and shorten the time between approval and value. When moving a proposal into funding, finance teams often request:

- A short economic narrative that states the problem, the dollar impact, and the ask

- A finance-auditable ROI workbook with live formulas and an assumptions tab

- A sensitivity table that varies adoption and utilization

- A timeline of the first value by quarter and milestones with named owners

- A metrics map that ties system fields to key performance indicators and describes how to prevent double-counting

- A risk register with mitigations for data quality, change management, and vendor dependency

Use Policy and AI Momentum to Unlock Resilient Long-Term Value

CFOs rebalance near-term moves with multi-year bets. Finance leaders adapt short-term strategy to policy while funding AI to improve forecasting and operating leverage. Blend cost-out in year one with durable revenue protection across years two and three to match that mindset and earn a faster yes.

Tie Funding to Milestones and Liquidity

Conclude by stating the investment, expected payback period, and funding milestones. Anchor the request in the reality that most treasury teams guard cash buffers.

Safety is the top short-term investment objective for 61% of organizations, reinforcing why milestone-based funding that protects liquidity earns faster approval. Confirm how the program protects liquidity through phased rollout, shared savings, or performance-based fees. That structure demonstrates respect for capital, reduces downside risk, and signals that the team will manage the project as if it were their own.

Speak the CFO’s Language

A business case wins when it treats the CFO as a partner in value creation. Anchor the story in profit, cash, and risk, then show the path to first value with numbers that finance can verify. Align on milestones and start small in a controlled slice of the business. This approach reduces uncertainty, fosters trust with finance, and allocates capital where it matters most.

Author Bio: Devin Partida, Editor in Chief for Rehack, provides today’s guest blog. Rehack is ‘a community of engaged and curious people at all stages of their technology journey.

Conclusion: How to Sell to the CFO to Enjoy Business Growth

Each industry and job title has its unique vocabulary and communication style. Before meeting, it’s wise to research the role of a CFO to gain a general understanding of their desired outcomes. However, avoid all assumptions; the groundwork is to prioritize questions to ask upon meeting. The answers they provide will lay the groundwork for more insightful conversations for you to sell to the CFO more effectively.

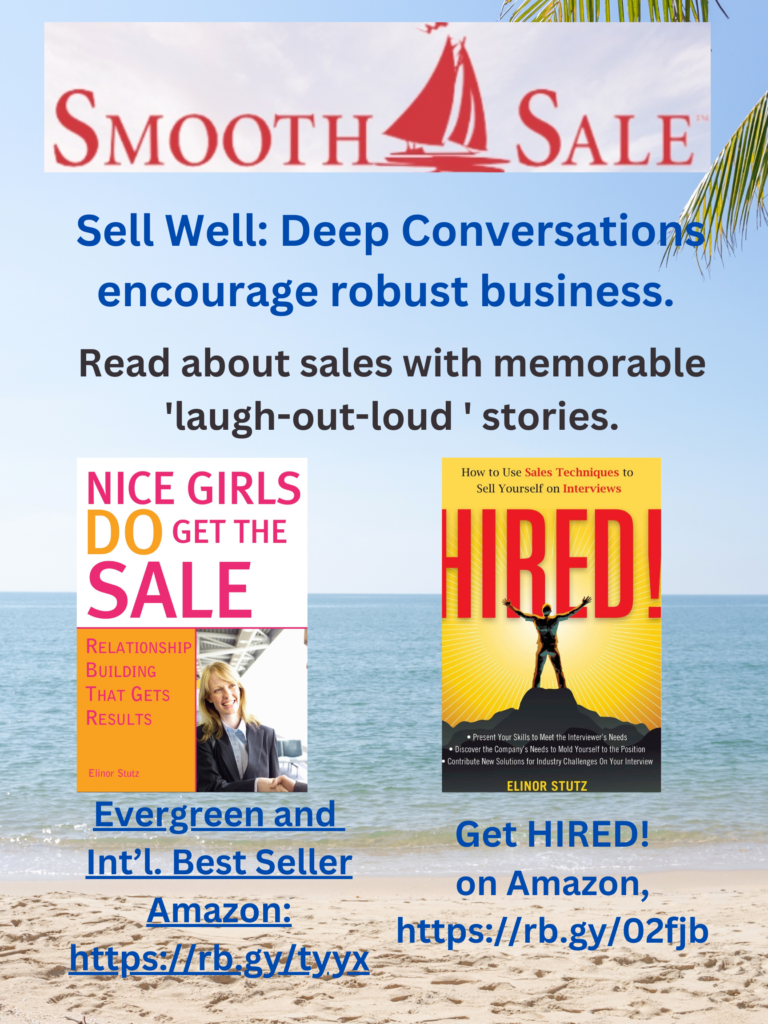

For more Insights, visit Elinor’s Amazon Author Page

Communicate to Attract Interest

Believe, Become, Empower

Be A Story-Teller

Address Needs, Wants, and Desires to Earn Sales

Ongoing Learning is Vital

Sales Tips: How to Sell to the CFO to Enjoy Business Growth

1. Commit to your long-term vision for accomplishment(s).

2. Research specific professions upfront to realize a better conversation direction to take.

3. Acknowledge the communication style of those you meet and attempt to align yours while remaining authentic.

4. Ask your clientele whether they have concerns about working together while conveying willingness to address them.

5. Never underestimate anyone’s novel ideas; remember that each person and country operates differently.

6. Share favorite learning moments with peers and current clients to improve client engagement.

7. Habitually seek out new ways to improve engagement for business growth.

8. At the end of all communications, ask team members involved if they have questions to ensure clarification.

9. ‘Don’t give up – find a better way!’

10. Celebrate Success!

Today’s insights are designed to help you achieve the Smooth Sale!

Visit Helpful Resources for Your Business:

Advisorpedia Publishes financial information to help advisors build their practice and, for those interested in the markets, choose investments for business growth and next-chapter retirement.

Author One Stop, Inc. – Book editing, coaching, ghostwriting, and pitching literary agents and publishers.

BabyBoomer – A trusted media source that collects and curates all the news and resources, plus offers a wide variety of excellent courses for the Baby Boomer generation.

BizCatalyst360 The website provides a life, culture, and biz new media digest as a hub of creative expression and personal growth.

CatCat: Build your future one skill at a time.

ContactOut is a web-based platform that enables users to search for contact information and uncover contact details, including email addresses, phone numbers, and other personal data.

Executives’ Diary Magazine Proudly features leaders from varying fields sharing their inspiring stories, including Elinor Stutz.

Fedica strives to understand your followers’ interests and create tailored content to encourage a returning and referring clientele.

Greg Jenkins Consulting LLC – Helping organizations realize the value of diversity to build inclusive, evolving, high-performing cultures.

Growth Hackers – Helping businesses globally grow with lead generation, growth marketing, conversion rate optimization, data analytics, user acquisition, retention, and sales.

Humanology International Institute – The institution that develops and safeguards humanology as a discipline worldwide.

Inclusion Allies Coalition: “Everyone is welcome here.” Learn more about training teams and joining the advocacy program.

Internet Advisor: Choose the exemplary internet service among 2083 providers in 36,380 cities. Cellphonedeal also compiles excellent phone deals, plans, and prepaid plans to furnish you with the best options in your area.

Inspired Movie Inspiration is a game changer for most; apply to an inspiring guiding light in conjunction with the Producer/Director of the Inspired movie, Patryk Wezowski,

Kred Connect with top-rated influencers to learn from and grow your networks.

LinktoEXPERT “It is not who you know – who knows you and what your expertise can do for them, plus understand the value of hiring you.”

Lotus Solution LLC Helps organizations create diversity and inclusion to ensure fairness and work through customized consulting, training, and keynote speeches.

Onalytica: Find relevant influencers for your brand.

SalesPop! Purveyors of Prosperity: How to Compete against Yourself to Excel in Your Career.

Simma Lieberman, “The Inclusionist,” helps develop inclusive leaders from the inside out to champion diversity and build equitable, inclusive cultures at every level.

Yoroflow offers a comprehensive suite of digital workplace platforms to help you streamline your day-to-day operations, manage your finances, and grow your business.

Vunela Offers a unique opportunity to view Videos and read articles by World Leaders.

Win Win Women is the world’s only interactive network and an international community for women. Women WIN when they receive solutions + Experts WIN when they provide solutions = Win Win Women.